Smci Earnings Date 2025

Smci Earnings Date 2025. Common stock (smci) including earnings per share, earnings forecasts at nasdaq.com. In 2025, super micro computer's revenue was $14.94 billion, an increase of 109.77% compared to the previous year's $7.12 billion.

On april 30, 2025, super micro computer inc (nasdaq:smci), a leader in ai, cloud, storage, and 5g/edge it solutions, disclosed its financial outcomes for the third quarter of fiscal year 2025, as. Earnings were $1.21 billion, an increase of 88.77%.

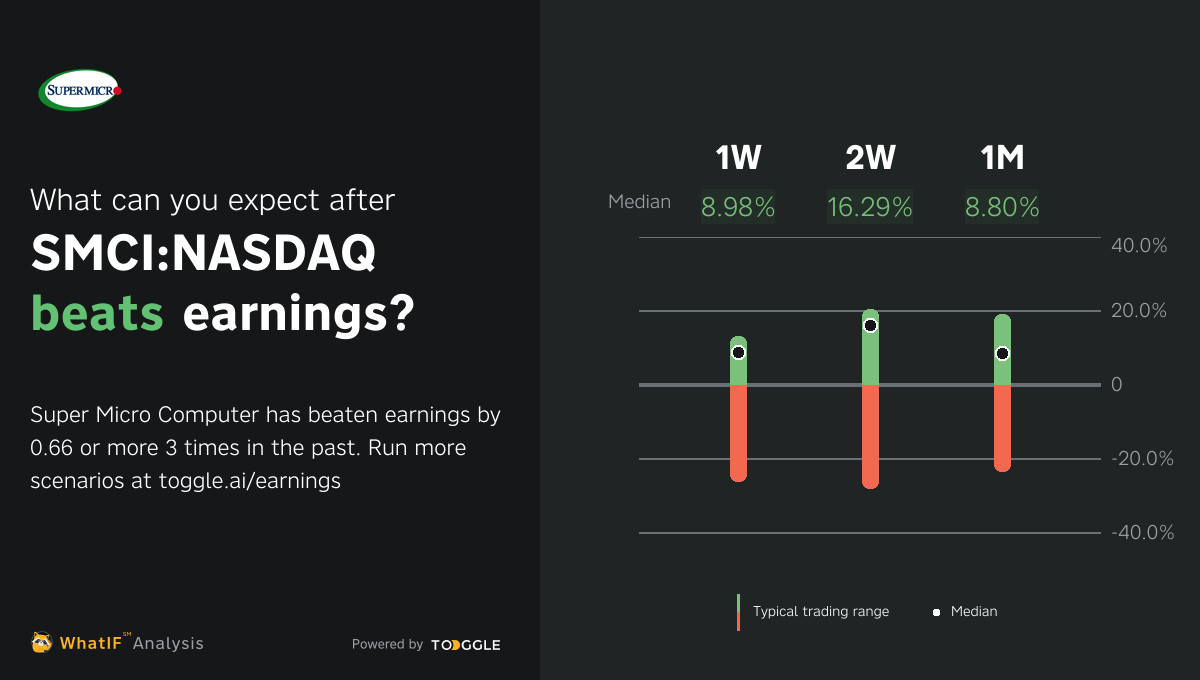

SMCINASDAQ Beat Q2 2025 Earnings by 0.66, In 2025, super micro computer's revenue was $14.94 billion, an increase of 109.77% compared to the previous year's $7.12 billion.

2025年Q2 Super Micro Computer (SMCI) 決算情報|INVESTMENT&FINANCIAL MAGAZINE, Smci) , a total it solution provider for ai, cloud, storage and 5g/edge, today announced financial results for its second quarter of fiscal year 2025 ended december 31, 2025.

Super Micro Computer Inc Earnings and 2025 SMCI Stock Analysis YouTube, (nasdaq:smci) q2 2025 earnings call transcript january 29, 2025.

SMCI Earnings Date, Financial Performance and More, Revenue, eps, surprise, history, news and analysis.

Super Micro (SMCI) Q3 earnings report 2025 SwiftTelecast, For the last reported fiscal year 2025 ending jun 30, 2025, smci reported annual earnings of $640.0m, with 124.4% growth.

Super Micro Computer, Inc. (SMCI) Q2 2025 Earnings Call Transcript(翻訳, For their last quarter, super micro computer (smci) reported earnings of $0.63 per share, missing the zacks consensus estimate of $0.80 per share.

SMCI Super Micro Computer Inc. (SMCI) Q4 2025 Earnings…, Common stock (smci) including earnings per share, earnings forecasts at nasdaq.com.

SMCI Stock Earnings Super Micro Computer Beats EPS, Misses Revenue for, Super micro computer (smci) will release its next earnings report on aug 6, 2025.

Super Micro Computer, Inc. (NASDAQSMCI) Q4 2025 Earnings Call, Goldman’s september 2025 research shows that 2025 revenue estimates of semiconductor firms, software enablers, and hardware firms except semiconductors are roughly 2.3x, 2.05x, and 1.8x over.