Georgia State Income Tax Brackets 2025

Georgia State Income Tax Brackets 2025. Your average tax rate is 10.94% and your. This year's individual income tax forms.

2025 georgia income tax returns must be received or postmarked by the. The deadline to file 2025 individual income tax returns, without an extension, is april 15, 2025.

2025 State Tax Rates and Brackets Tax Foundation, Here’s a concise breakdown of the same: In south carolina, nfib was on the front line on.

When Will 2025 Tax Brackets Be Released 2025 JWG, The tax tables below include the tax rates, thresholds and allowances included in the georgia tax calculator 2025. 2025 federal income tax brackets for single filers.

Lawmakers Might Come to Regret Risky Tax Plan, This year's individual income tax forms. Updated 1:12 pm pdt, march 20, 2025.

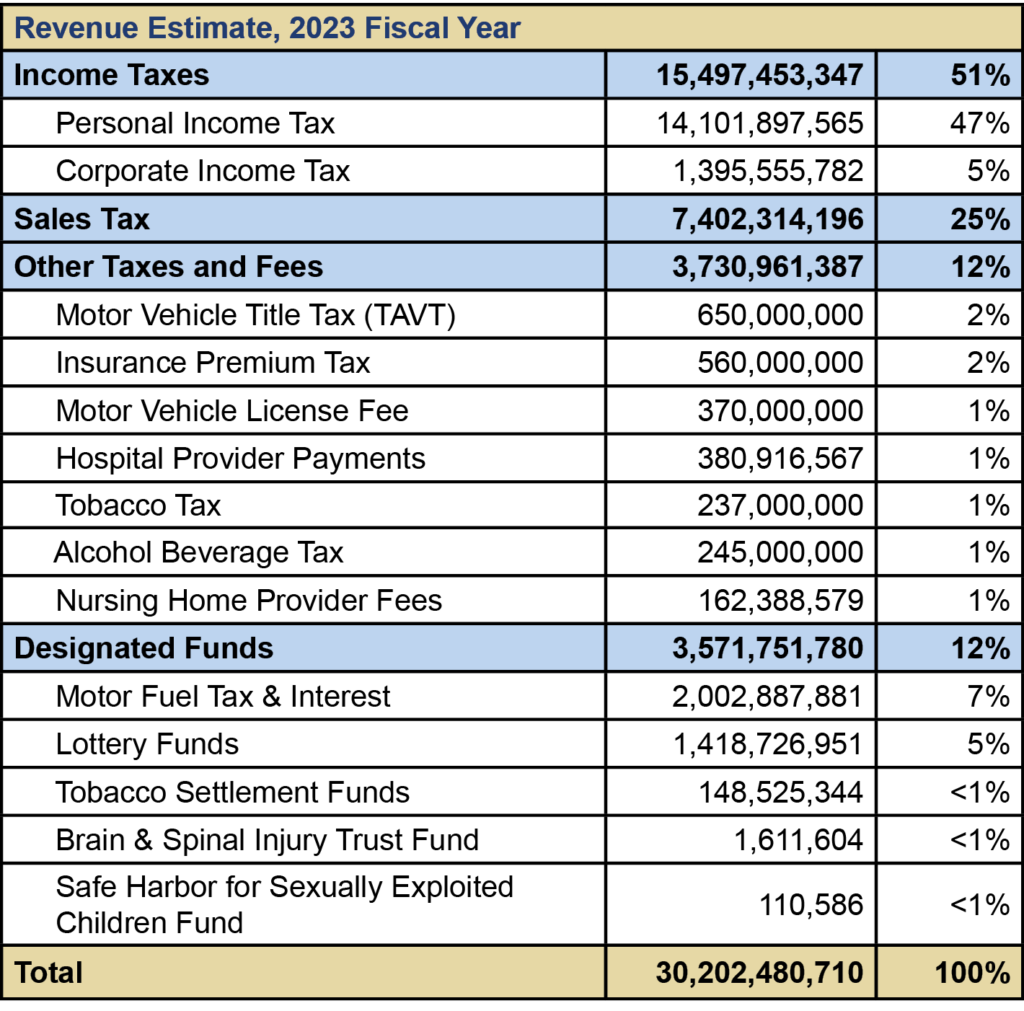

Revenue Primer for State Fiscal Year 2025 Budget and, (q) north dakota imposes a 3.5% surtax for filers electing to use the water’s edge method to apportion income. Updated 1:12 pm pdt, march 20, 2025.

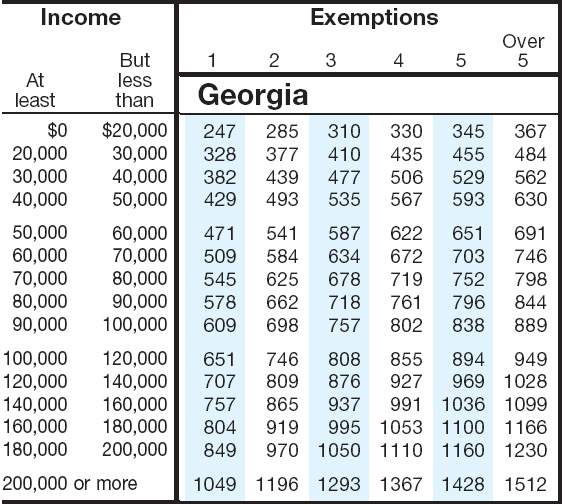

State Taxes Ga State Taxes 2014, State of georgia department of revenue. A minimum tax ranges from $25 to $200,000, depending on receipts ($250 minimum for banks).

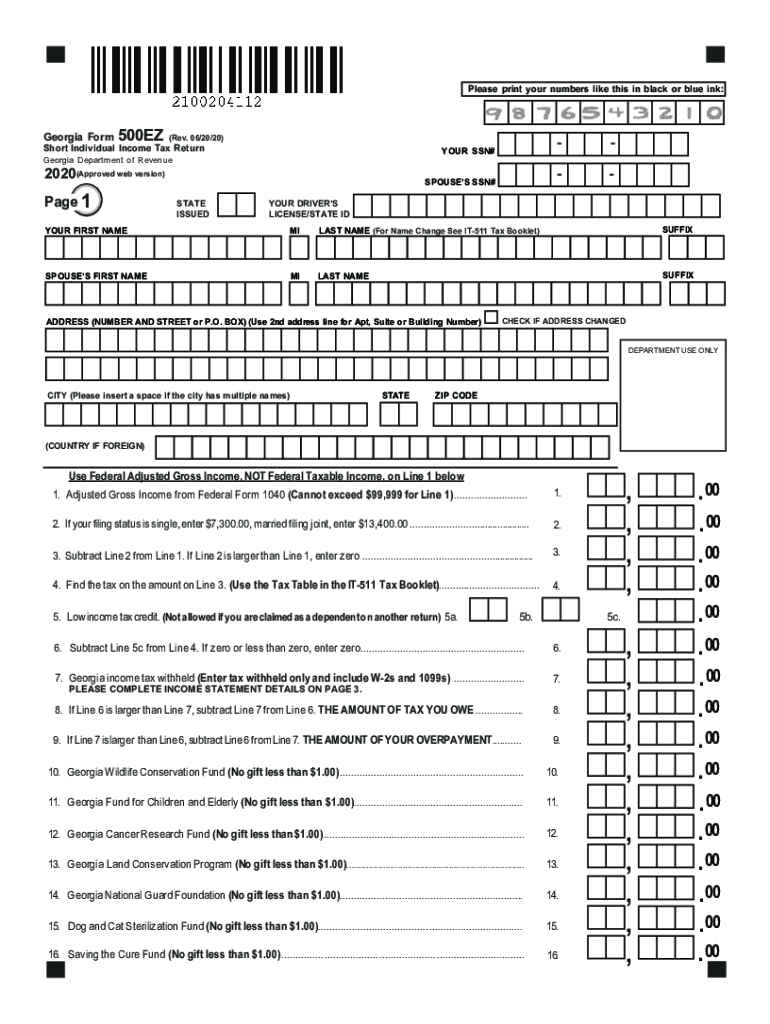

Tax Complete with ease airSlate SignNow, 2025 employer’s withholding tax guide. By accelerating the reduction, the rate for tax year 2025 will be 5.39 percent, rather than the 5.49 percent set by hb 1437.

Texas Constitutional Amendment to Prohibit Individual Taxation, 1%, 2%, 3%, 4%, 5% and 5.75%. The following updates have been applied to the tax calculator:

Revenue Primer for State Fiscal Year 2025 Budget and, Answers to frequently asked questions. The tax rate (s) that apply to you depend on taxable income and filing.

Federal Bracket 2025 Clara Demetra, Georgia introduces flat income tax rate for 2025. Married filing jointly / head of household.

Free Printable Tax Form 500 Printable Forms Free Online, As of monday, the new year brought in a new tax rate, lowered from an income tax of 5.75% to 5.49%. Income tax tables and other tax information is sourced from the georgia department of revenue.